What is a Mega Backdoor Roth?

The Mega Backdoor Roth is a strategy that could allow you to contribute an extra $37,000 to your Roth IRA every year!

Before we dive into the details, some background info is required first…

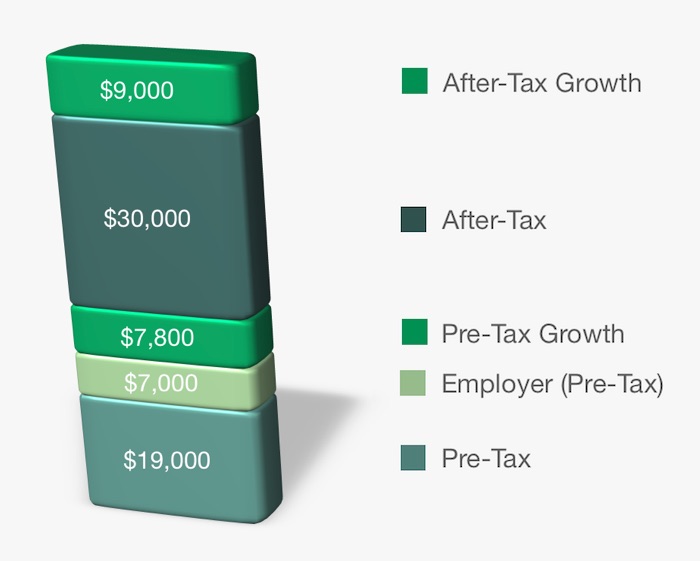

When contributing to a 401(k), there are three different types of contributions that you can make:

Pre-Tax Contributions

For a normal 401(k), the amount that automatically gets contributed from your paycheck is a pre-tax contribution.

Pre-tax contributions are tax-free going in and they grow tax free but you have to pay tax on the money when you withdraw it.

The limit on the amount of pre-tax 401(k) contributions you can make in 2019 is $19,000.

Note: If your employer matches a portion of your contributions, these employer contributions are also pre-tax but they do not affect the $19,000 annual personal limit.

If you plan to retire early, it makes sense to take advantage of as many pre-tax contributions as you can (click here to learn why).

Roth Contributions

If you have a Roth 401(k) instead, the contributions you make are considered Roth contributions.

Roth contributions are made with after-tax money (i.e. you paid tax on the money before putting it into the Roth) but the contributions are allowed to grow tax free and all principal and earnings can be withdrawn tax free when you reach standard retirement age.

After-Tax Contributions

The least-known type of contribution you can make is an after-tax contribution.

After-tax contributions are made with money you’ve already paid tax on (like Roth contributions) and can grow tax-free but the growth will be taxed upon withdrawal.

Depending on how much your employer contributes to your retirement account, you could potentially contribute up to $37,000 extra into your 401(k) every year with after-tax contributions.

The total 401(k) contribution limit for 2019 is $56,000 so to figure out how much in after-tax contributions you could make, simply subtract your personal pre-tax/Roth contributions and your employer contributions from $56,000.

For example, if someone maxes out their 401(k) in 2019 and their employer contributes $7,000, their after-tax contribution limit would be $56,000 – $19,000 – $7,000 = $30,000.

Now that we’ve established the type of contributions you can make to your 401(k), you may be wondering what this has to do with the Mega Backdoor Roth IRA strategy?

Let’s dive in…

Moving Money from Your 401(k) to Your IRA

The IRS has stated that when transferring money from you 401(k) into your IRAs, you are able to divert the pre-tax portion of your 401(k) (and all the investment growth) to your Traditional IRA and the after-tax portion to your Roth IRA, without paying any tax.

This is a big deal for people who can make in-service distributions (i.e. 401(k)-to-IRA transfers while still employed) or those of us who plan to leave our full-time employer soon because this allows us to dramatically boost our Roth IRA contributions!

Suboptimal Example

Assume that you decide to max out your pre-tax 401(k) contributions, you convince your employer to contribute $7,000 immediately, and you max out your after-tax contributions as well.

Here’s what your 401(k) would look like on January 1st:

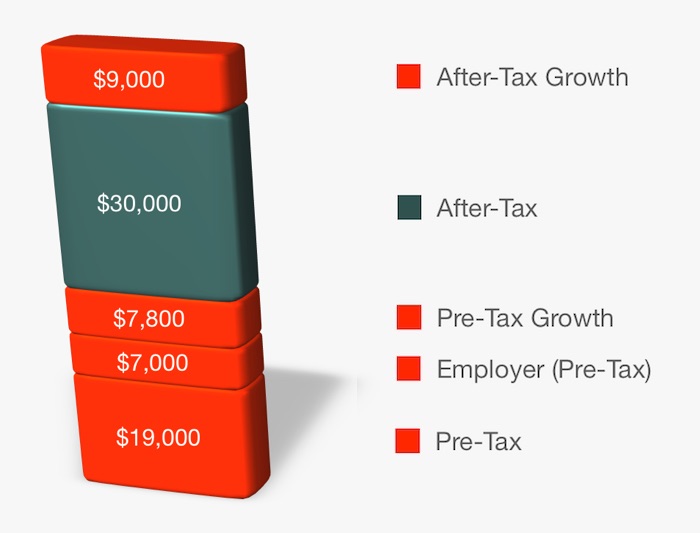

Next, assume you just leave it there and when you eventually leave your job, you find that the market has increased your 401(k) balance by 30%!

Here’s what your 401(k) would look like:

Since all pre-tax contributions and all growth within the 401(k) will be taxed, here’s the money that would be subject to tax once you decide to tap into the account:

As you can see, you don’t really have tax-free gains on the after-tax contributions, you have tax-deferred gains instead (because you eventually have to pay tax on the money).

Let’s take a look at a better way to handle after-tax contributions…

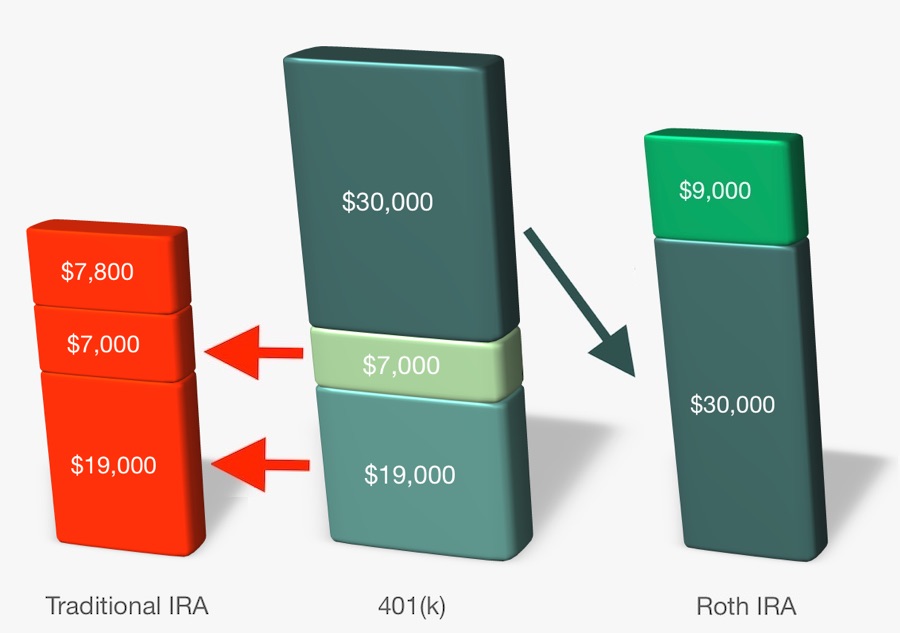

Mega Backdoor Roth Example

Assume the same scenario but rather than leave everything in the 401(k) to grow, you instead immediately rollover your entire balance to two separate IRAs using an in-service withdrawal on January 1st, 2019.

According to the IRS guidance, the pre-tax contributions can go directly into a Traditional IRA and the after-tax contributions can go directly into a Roth IRA.

Here’s what your two IRA accounts would look like when you finally decide to take your money out:

You can see that the $9,000 of gains on the after-tax contributions that would have been taxed in the suboptimal scenario are now protected in the Roth IRA and will be tax free whenever you decide to withdraw the money!

Conclusion

If you are already maxing out your pre-tax 401(k) contributions (see this post for why I believe pre-tax contributions are better than Roth contributions for early retirees) and are also maxing out your IRA, you should check with your 401(k) custodian to see if you can start making after-tax contributions as well.

After-tax 401(k) contributions could allow you to contribute up to $37,000 extra to your Roth IRA every year (in addition to the normal $6,000 IRA contribution limit for 2019).

If you are able to perform in-service withdrawals, you can minimize the amount of growth that takes place before the conversion, which will shield even more of your money from taxes!

What do you think? Do you have the ability to make after-tax contributions? How about in-service withdrawals? Are you going to take advantage of this strategy?